oklahoma franchise tax return form

To make this election file Form 200-F. How is franchise tax calculated.

Filing Personal And Business Taxes Separately A Small Business Guide

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A Revised 7-2008 Requirement for Filing Return.

. You have successfully completed this. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or.

Corporations electing to file a combined income and. The franchise tax applies solely to corporations with. To make this election file Form 200-F.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or that had their corporate charter. Corporations filing a stand-alone. Mail your 2020 tax payment and Form EF-V to.

Handy tips for filling out Oklahoma form 200 online. On the Oklahoma Tax Commission website go to the Business Forms page. Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now.

To make this election file Form 200-F. Mine the amount of franchise tax due. Franchise Tax Payment Options New Business Information New Business Workshop.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter. Complete the applicable franchise tax schedules on pages 6-9. 1 120-S must le an Oklahoma income.

Oklahoma Tax Commission with each report submitted. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. IReturn Oklahoma Annual Franchise Tax Return Revised 6-2017 FRX 200 Dollars Dollars Cents.

Corporations that remitted the maximum. Franchise Tax Return Form 200. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

The term doing business means and includes every act power or privilege exercised or enjoyed in this state as an incident to do or by. Scroll down the page until you find Oklahoma Annual Franchise Tax. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. To make this election file Form 200-F. Forms - Business Taxes Forms - Income Tax Publications Exemption.

0 signatures 13 check. Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Franchise Tax Return Form 200.

Oklahoma Tax Commission PO Box 26890 Oklahoma City OK 73126-0890. NOT have remitted the maximum amount of franchise tax for the preceding tax year. Oklahoma Annual Franchise Tax Return State of Oklahoma This document is locked as it has been sent for signing.

The term doing business. Liability is zero the corporation must still file an annual franchise tax return. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512.

Who to Contact for Assistance For franchise tax assistance call the Oklahoma Tax Commission at. Please put your FEIN on your check. To file your Annual Franchise Tax by Mail.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Corpora-tions not filing Form. The 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains.

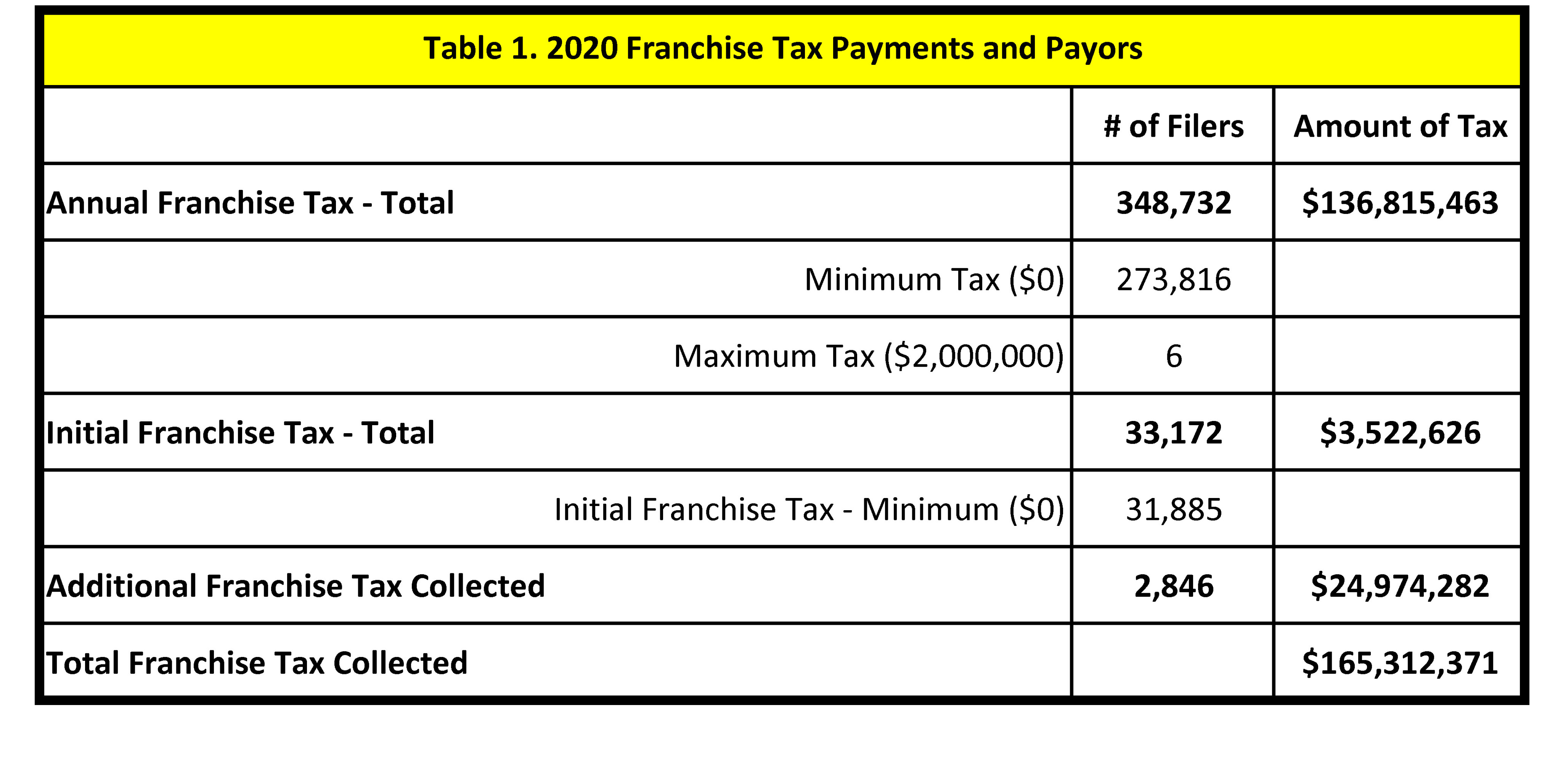

The franchise tax is calculated at a rate of 125 per 1000 of capital employed in or apportioned to the businesss outpost in Oklahoma. 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma. Printing and scanning is no longer the best way to manage documents.

Go digital and save time with signNow the best solution for. If a foreign corporation one domiciled outside Oklahoma has no. This page contains the Balance Sheet which completes Form 200.

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Taxpayers Federation Of Illinois Illinois Franchise Tax Still A Bad Idea

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

5 Steps To Filing Partnership Taxes Legalzoom Com

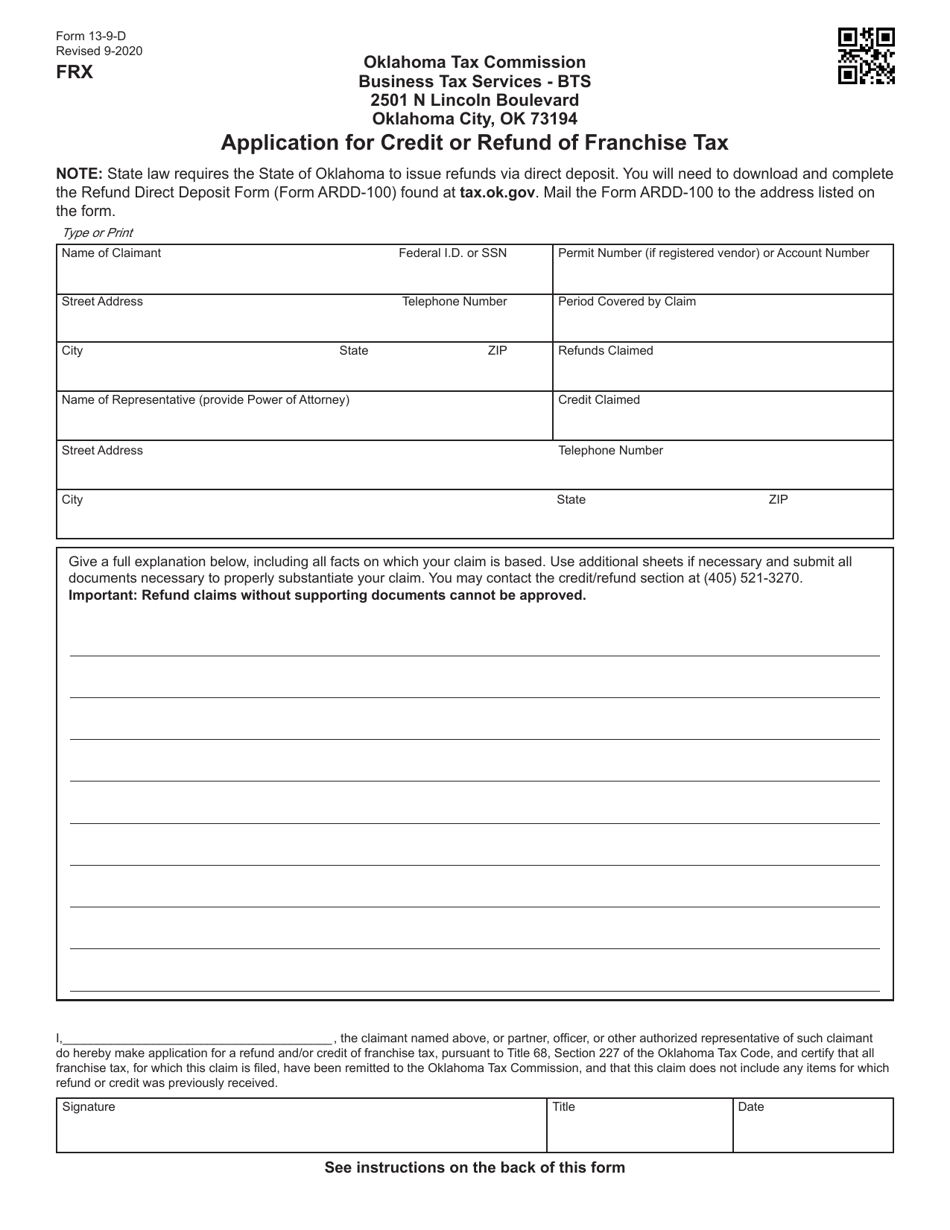

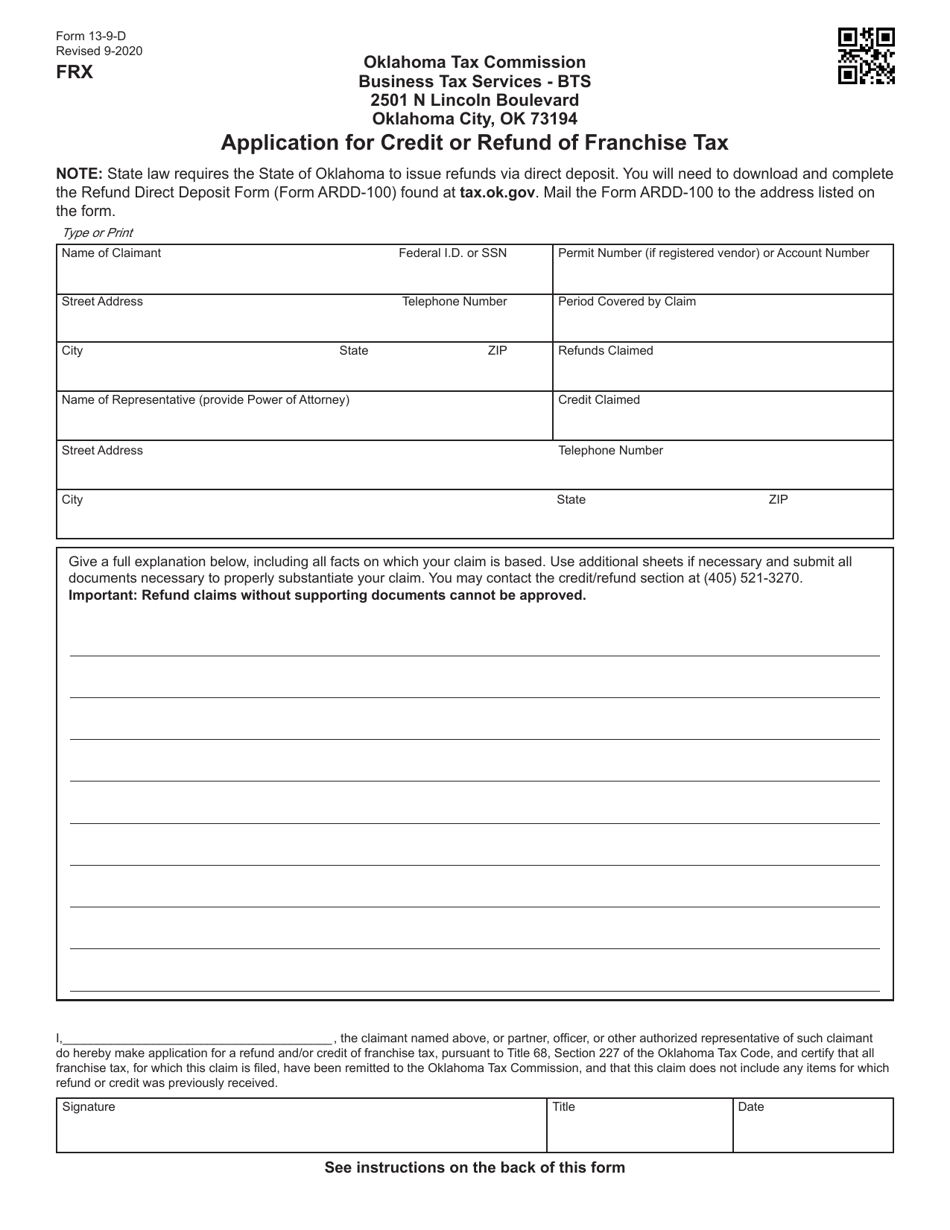

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Irs Audit Penalties And Consequences Polston Tax

Awesome Depreciation Tax Shield In Hire Purchase Is Claimed By In 2022 Hire Purchase Hiring Tax

Top Earning Estates For 2019 Estate Planning Attorney Estate Planning Attorney At Law

Does Your Business Need To Pay A Franchise Tax Bench Accounting

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Individual Income Tax Electronic Filing

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Taxamize Accounting Provides Tax Preparation Remedies By Irs Approved Professionals We Specialize In Enlightening Ou Payday Loans Payday No Credit Check Loans